Unemployed Loans: Fiscal Guidance Options for These With out Money

Becoming unemployed is usually a hard expertise, specially when financial obligations continue on to pile up. Financial loans for unemployed people are built to deliver reduction and aid for the duration of instances of economic problem. This short article explores what unemployed financial loans are, the options offered, and how to navigate the procedure responsibly.

What exactly are Unemployed Loans?

Unemployed financial loans are financial products tailor-made to individuals who are at the moment out of work. These loans usually think about alternate sources of income, such as govt Positive aspects, facet gigs, or cost savings, rather then classic work-centered cash flow.

How can Unemployed Loans Operate?

Lenders supplying financial loans to unemployed persons evaluate variables beyond a steady paycheck, including:

Credit Score: An excellent credit score background can improve your likelihood of approval.

Collateral: Some loans might require belongings as protection.

Choice Cash flow: Proof of other income resources, for instance unemployment Positive aspects, pensions, or freelance do the job.

Different types of Loans for your Unemployed

Personalized Loans

Several economical establishments supply private loans for unemployed men and women with flexible repayment phrases. These loans may possibly involve evidence of another earnings resource or collateral.

Payday Loans

Payday financial loans give fast use of tiny amounts of income but frequently include large-curiosity prices and quick repayment durations. Use this option cautiously and just for emergencies.

Secured Loans

Secured financial loans demand collateral, such as assets or a car or truck, to guarantee repayment. These financial loans typically have lower desire charges but have the chance of shedding your asset in the event you default.

Government Guidance Plans

Some governments present reduced-fascination or no-interest loans for unemployed persons as Component of social welfare plans. Check your local governing administration sources for availability.

Peer-to-Peer (P2P) Lending

P2P lending platforms link borrowers with unique lenders willing to offer you financial loans based upon mutual agreements. Terms may vary broadly, so review agreements cautiously.

Benefits of Unemployed Loans

Quick Economic Reduction: Tackle urgent bills like lease, utilities, or health care costs.

Versatile Eligibility Standards: A lot of lenders take into account choice profits sources.

Develop Credit: Well timed repayment can transform your credit rating score.

Challenges and Troubles

Substantial Interest Fees: Financial loans for the unemployed often come with increased charges to offset the lender's risk.

Credit card debt Accumulation: Borrowing with no clear repayment system can result in economical strain.

Potential Cons: Be cautious of predatory lenders presenting unrealistic conditions.

Tricks for Responsible Borrowing

Appraise Your requirements: Borrow only what you need and may fairly repay.

Compare Possibilities: Research and Examine lenders to locate favorable terms.

Stay away from High-Fascination Financial loans: Keep away from loans with exorbitant costs and costs.

Make a Repayment System: Ensure you Possess a strategy to repay the mortgage promptly.

Choices to Financial loans with the Unemployed

Unexpected emergency Discounts: Faucet into your personal savings to protect bills.

Federal government Positive aspects: Check out unemployment Advantages and social assistance courses.

Family and Friends: Borrowing from dependable persons generally is a minimal-Price alternate.

Gig Financial state Positions: Contemplate non permanent or freelance operate to produce profits.

Conclusion

Unemployed loans generally is a lifeline throughout hard instances, but they have to be approached with warning and responsibility. Knowledge the conditions, Checking out options, and setting up for repayment are very important to staying away from prolonged-time period financial concerns. For anyone who is considering an unemployed mortgage, check with a money advisor to ensure you're generating the top final decision for your personal situations.

Learn more info. check out here: 비상금대출

Tony Danza Then & Now!

Tony Danza Then & Now! Ross Bagley Then & Now!

Ross Bagley Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Kelly Le Brock Then & Now!

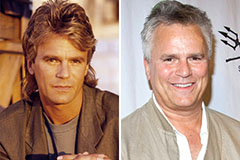

Kelly Le Brock Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!